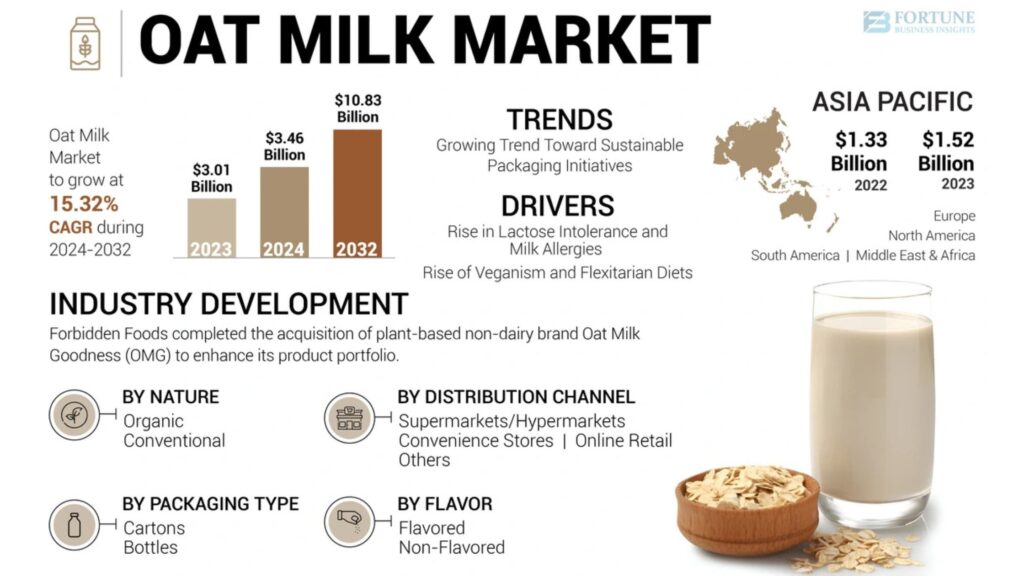

The global oat milk market reached a valuation of USD 3.01 billion in 2023 and is projected to expand from USD 3.46 billion in 2024 to USD 10.83 billion by 2032, registering a robust compound annual growth rate (CAGR) of 15.32% over the forecast period. Asia Pacific led the market in 2023, holding 50.5% of the global share. Industry leaders are increasingly focusing on product innovation, sustainable practices, and strategic partnerships to enhance their competitiveness amid rising demand for plant-based alternatives. These companies are tailoring their approaches to meet evolving consumer expectations in an increasingly dynamic market environment.

Oat milk, derived mainly from oats and water, is a popular dairy substitute enriched with essential vitamins and minerals. It is free from lactose, nuts, and dairy, making it an ideal option for individuals with dietary sensitivities. Market expansion is being driven by growing awareness of its health benefits, rising incidences of lactose intolerance and milk allergies, and the broader trend toward plant-based diets. The outlook for the market remains strong, supported by continuous innovation and broader retail availability.

Get Sample PDF Brochure: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/oat-milk-market-110935

Market Segmentation

Conventional Products to Lead Due to Cost-Effectiveness and Accessibility

Based on nature, the market is segmented into organic and conventional products. The conventional segment is expected to dominate due to its affordability and widespread availability, appealing to a broad consumer base.

Cartons Preferred for Their Shelf-Life and Product Preservation

In terms of packaging, the market is categorized into cartons and bottles. Cartons are projected to remain the most popular packaging type, largely due to their effectiveness in maintaining freshness and protecting product quality.

Non-Flavored Variant Popular for Culinary Versatility

By flavor, the market is split into flavored and non-flavored variants. The non-flavored segment holds the largest market share, thanks to its versatility for use in coffee, smoothies, and cooking.

Supermarkets/Hypermarkets Lead in Distribution

Regarding distribution channels, the market includes supermarkets/hypermarkets, convenience stores, online retailers, and others. Supermarkets and hypermarkets currently dominate due to their accessibility and variety of brands and products offered to consumers.

Report Scope and Insights

This report offers a comprehensive analysis of the oat milk market, covering applications, product nature, packaging types, flavors, distribution channels, and leading companies. It also explores current market trends, emerging opportunities, and significant industry developments that contribute to market growth.

Market Drivers and Challenges

Rising Lactose Intolerance Rates Driving Demand

A growing number of consumers, particularly in North America, are lactose intolerant. According to Boston Children’s Hospital, between 30 and 50 million Americans are affected. This trend has led to increased demand for non-dairy alternatives like oat milk, which is allergen-friendly—free from lactose, soy, and nuts—making it suitable for individuals with various dietary restrictions. These characteristics are propelling its widespread adoption.

Niche Market Perception May Limit Growth

Despite growing interest, oat milk is still perceived by some as a niche product, which could hinder its mainstream acceptance and create challenges for manufacturers seeking to scale their operations.

Regional Analysis

Asia Pacific at the Forefront Due to Emerging Economies

Asia Pacific held the largest market share in 2023, at 50.61%, driven by rapidly growing economies like India and China. Increasing interest in vegan and flexitarian diets, alongside rising awareness through vegan events and initiatives, is fueling demand in the region.

North America Expected to Grow Steadily

North America is poised for strong growth due to the presence of major market players such as Oatly Group AB, Planet Oat, Califia Farms, Danone SA, and Ripple Foods. The region benefits from strong brand visibility and consumer awareness.

Competitive Landscape

Key Players Focusing on Innovation and Strategic Expansion

The oat milk market features moderate competition, with leading companies pursuing various growth strategies. These include investment in research and development, new product introductions, and strategic mergers and acquisitions to strengthen market presence and meet evolving consumer demands.

Prominent Companies Featured in the Report:

- HP Hood LLC (U.S.)

- Danone S.A. (France)

- Chobani, LLC (U.S.)

- Campbell Soup Company (U.S.)

- Oatly Group AB (Sweden)

- Califia Farms (U.S.)

- Hain Celestial Group, Inc. (U.S.)

- Smile Foods (U.S.)

- Boring (New Zealand)

- Earth’s Own Food Company (Canada)

Ask For Customization: https://www.fortunebusinessinsights.com/enquiry/ask-for-customization/oat-milk-market-110935

Key Industry Development:

- September 2024: Forbidden Foods, an Australian-owned food company, acquired Oat Milk Goodness (OMG), a plant-based beverage brand. The acquisition expands Forbidden Foods’ portfolio by integrating OMG’s oat milk and flavored beverage products, enhancing its market presence.