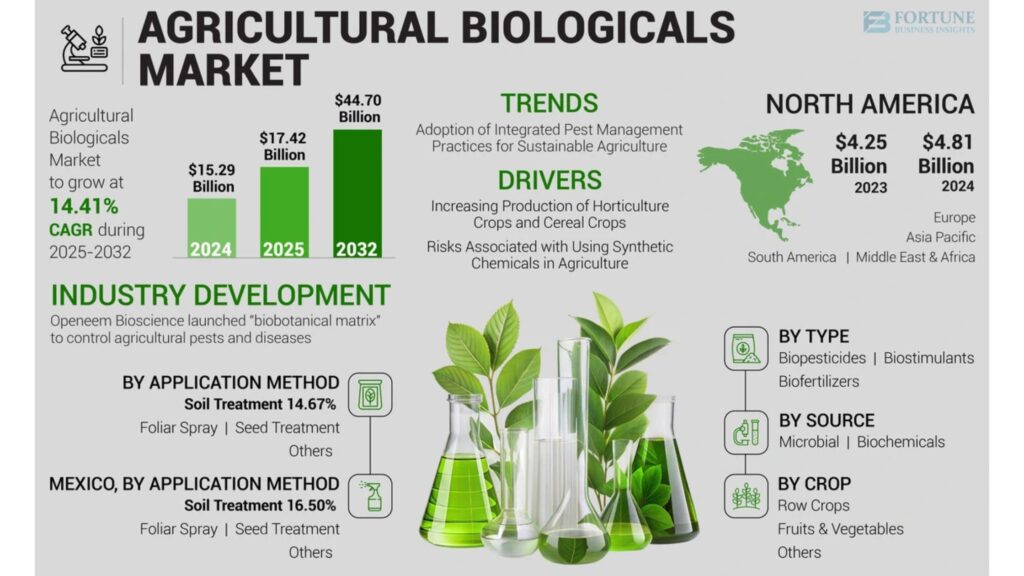

The global agricultural biologicals market size was valued at USD 15.29 billion in 2024 and is anticipated to grow from USD 17.42 billion in 2025 to USD 44.70 billion by 2032, reflecting a CAGR of 14.41% during the forecast period. In 2024, North America held the largest market share at 31.46%. Additionally, the U.S. agricultural biologicals market is projected to reach USD 10.09 billion by 2032, driven by the rising prevalence of plant diseases and increased registration and approval of agricultural biological products.

The excessive use of crop protection chemicals, which harms the environment, is expected to drive demand for biological products. These products can be used independently or combined with synthetic pest-resistant chemicals. Their broad agricultural applications are projected to accelerate market growth. Moreover, rising demand for agricultural biologicals in pre- and post-harvest crop management is anticipated to support market expansion. Commercialization can be enhanced through product innovation strategies, comprehensive last-mile services, and strong marketing and distribution networks.

Information Source: https://www.fortunebusinessinsights.com/industry-reports/agricultural-biologicals-market-100411

Segmentation

Biopesticides Segment Leads Due to Focus on Pest-resistant Products

By type, the market is segmented into biofertilizers, biopesticides, and biostimulants. The biopesticides segment held the largest share in 2023, attributed to the growing focus of farmers and agriculturists on developing pest-resistant products to improve crop yield and quality.

Microbials Segment Gains Traction with Increased Adoption

Based on source, the market is divided into biochemicals and microbials. The microbial segment commands a major share due to the increasing adoption of microbial solutions by farmers to address key agricultural challenges.

Foliar Spray Segment Dominates with Rising Adoption Among Farmers

Regarding application method, the market is categorized into seed treatment, soil treatment, foliar spray, and others. The foliar spray segment held a significant share in 2023, driven by its widespread adoption among conventional and organic farmers.

Row Crops Segment to Lead Due to Rising Demand for Less Processed Foods

By crop type, the market is segmented into fruits & vegetables, row crops, and others. The row crops segment dominated in 2023, supported by the increasing consumer preference for minimally processed organic foods.

Regionally, the market is segmented into Europe, the Asia Pacific, North America, the Middle East & Africa, and Europe.

Report Coverage

The report provides a comprehensive analysis of key market drivers, restraints, top trends, and the impact of COVID-19. It also highlights key industry developments and strategies adopted by leading companies to maintain their market position.

Drivers and Restraints

Adoption of Integrated Pest Management Practices to Fuel Growth

The increasing adoption of integrated pest management practices is a significant driver of market growth. The rising preference for biopesticides among farmers using sustainable and eco-friendly crop protection methods further supports market expansion.

However, the absence of well-defined regulatory guidelines for biological products may pose challenges to market growth.

Regional Insights

North America Leads with Rising Field Crop Acreage

North America accounted for the largest market share in 2023, attributed to the expanding field crop acreage for soybeans, cotton, and wheat, alongside rising cases of plant diseases.

In Europe, market growth is driven by rising nitrogen and phosphorus-based fertilizer prices.

Competitive Landscape

Product Development Strategies Enhance Market Position

The agricultural biologicals market is moderately consolidated, with several emerging and established players. Leading companies maintain a strong position due to extensive global food production, robust brand loyalty, and vast distribution networks. Top firms are adopting product development strategies to reinforce their market presence.

List of Key Players Mentioned in the Report:

- Bayer AG (Germany)

- BASF SE (Germany)

- Syngenta AG (Switzerland)

- UPL Limited (India)

- Marrone Bio Innovations (U.S.)

- SEIPASA S.A. (Spain)

- Koppert Biological Systems (Netherlands)

- PI Industries (India)

- Novozymes A/S (Denmark)

- Gowan Group (U.S.)

Get Sample PDF Brochure: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/agricultural-biologicals-market-100411

Key Industry Development

In August 2022, Chambal Fertilizers and Chemicals Limited (CFCL) launched UTTAM SUPERRHIZA, its first Mycorrhiza product in the biofertilizers category. The product incorporates advanced growth promoter technology, utilizing native biological inputs to enhance Mycorrhiza performance.