The global bio-naphtha market is witnessing significant growth, driven by increasing demand for sustainable and renewable alternatives to fossil fuels. Bio-naphtha, derived from biological feedstocks such as vegetable oils, agricultural waste, and used cooking oil, serves as an eco-friendly substitute for conventional naphtha in various industries including petrochemicals, transportation, and energy.

Market Overview

The transition toward a circular and low-carbon economy is propelling the demand for bio-naphtha worldwide. This renewable chemical feedstock is primarily used in the production of olefins, plastics, and gasoline blending. Growing awareness about greenhouse gas (GHG) reduction and supportive government regulations encouraging the use of bio-based products further boost the market growth.

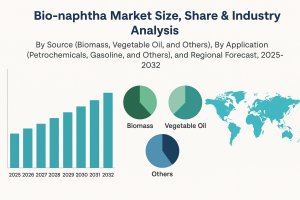

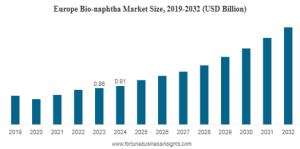

According to industry analysis, the bio-naphtha market is expected to grow at a healthy CAGR during 2024–2032, driven by robust demand from the petrochemical and energy sectors.

Request a FREE Sample Copy: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/bio-based-naphtha-market-112751

Key Market Drivers

Rising Environmental Concerns: Increasing emphasis on reducing carbon emissions and dependence on fossil fuels is accelerating the adoption of bio-naphtha.

Government Policies and Incentives: Policies promoting bio-based energy sources and renewable feedstocks across Europe and North America are creating new growth avenues.

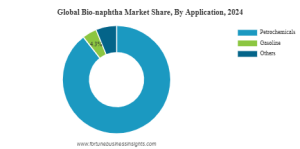

Growing Demand from Petrochemical Industry: Bio-naphtha is a crucial raw material for producing ethylene and propylene, essential for manufacturing plastics, detergents, and solvents.

Technological Advancements: Innovations in bio-refining and conversion technologies are improving yield efficiency, lowering costs, and enhancing product quality.

Market Segmentation

By Feedstock:

Vegetable Oils

Used Cooking Oils

Animal Fats

Agricultural Residues

Others

By Application:

Fuel Blending

Steam Cracking

Chemical Production

Others

By End-Use Industry:

Petrochemical

Energy & Power

Automotive

Others

By Region:

Europe – Dominates the market owing to strong biofuel mandates and sustainability initiatives.

North America – Rapid expansion of renewable energy infrastructure supports growth.

Asia Pacific – Emerging economies like Japan and South Korea are investing in bio-based alternatives to meet carbon neutrality goals.

Latin America & Middle East – Growing renewable resource availability and refinery investments bolster regional opportunities.

List of Top Bio-naphtha Companies Profiled

- UPM Biofuels (Finland)

- Montana Renewables LLC (U.S.)

- TOPSOE (Denmark)

- Chevron (U.S.)

- Mitsui Chemicals (Japan)

- Eni S.p.A. (Italy)

- TotalEnergies (France)

- Neste Oil Corporation (Finland)

- OMV Group (Austria)

These companies are investing heavily in advanced biorefineries and sustainable sourcing to meet the rising global demand.

Information Source: https://www.fortunebusinessinsights.com/bio-based-naphtha-market-112751

The bio-naphtha market is expected to expand significantly as industries and governments intensify efforts toward achieving carbon neutrality. Increasing use in bio-based plastics, biofuels, and chemical feedstocks will further strengthen market growth. Continuous research and innovation will be key in overcoming production cost challenges and achieving large-scale commercialization.

- December 2024: BASF and INOCAS partnered to develop a sustainable supply of Macaúba oil in Brazil, with a focus on its use in bio-naphtha production. This initiative will involve scaling up INOCAS’s Macaúba cultivation program and providing BASF with both kernel and pulp oils. The pulp oil will be used to produce bio-naphtha, which can be transformed into various products, including polymers, solvents, detergents, and fuels. Commercial volumes of the kernel oil are expected by 2025, with a regular supply of pulp oil for bio-naphtha production starting in 2027.

- July 2024: Mitsubishi Corporation and Neste partnered to increase the availability of bio-naphtha in Japan, encouraging its adoption by Japanese downstream companies. This collaboration aims to facilitate the transition from conventional petroleum naphtha to bio-naphtha in the production of various petrochemical products such as plastics and chemicals.