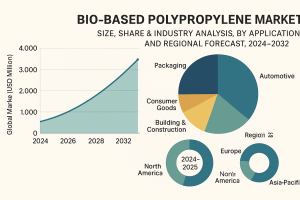

According to Fortune Business Insights, The global bio-based polypropylene market size was USD 183.5 million in 2023 and is projected to grow from USD 255.8 million in 2024 to USD 3,824.1 million by 2032 at a CAGR of 39.9% during the forecast period (2024-2032). Europe dominated the bio-based polypropylene market with a market share of 51.5% in 2023.

Bio-based polypropylene (PP) is a polymer compound derived from plants and has balanced properties as standard polypropylene. This polymer is manufactured from materials such as corn, vegetable oils, and sugarcane. This polymer is a sustainable alternative to traditional synthetic polypropylene that is used with other material such as fiberglass for several applications. These applications include injection molding, and films for packaging, textiles.

Request a FREE Sample Copy: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/bio-based-polypropylene-market-102758

LIST OF KEY COMPANIES PROFILED

- Mitsui Chemicals, Inc. (Japan)

- LyondellBasell Industries Holdings B.V. (The Netherlands)

- NaturePlast (France)

- Neste Oyj (Finland)

- Borealis AG. (Austria)

- Braskem (U.S.)

Braskem America Introduces Green Polypropylene

Braskem, one of the leading bio-polymer producers in the world, announced the release of ‘I’m green’ recycled green polypropylene (PP) in October 2019. Representing one of the first bio-based polypropylene formulations under the ‘I’m green’ portfolio, the recycled PP offering is aimed at advancing Braskem’s commitment to transform the linear economy of plastics into a circular one. The ‘I’m green’ umbrella brand of Braskem also includes post-consumer-recycled (PCR) resins, bio-based resins, and a mix of bio-plastics and PCR solutions. The launch of the novel bio-based PP will enable Braskem to firmly secure its position in the bio-plastics industry as well as cater to a wide range of end-user industries.

Widening Application of Bio-based PP in Auto Manufacturing to Fuel the Market

Conventionally formulated polypropylene has been one of the mainstay raw materials adopted by vehicle manufacturers to make cost-efficient interior components. However, with an increasing emphasis on improving the sustainability quotient in the auto industry, auto companies are steadily transitioning towards biodegradable materials to make their vehicles lightweight and energy-efficient. Bio-based polypropylene is speedily becoming the preferred choice of material for automakers due to its high recyclability and biodegradability. For example, General Motors has been utilizing bio-based PP for seatbacks in its Cadillac DeVille and PP derived from flax for its trim and shelving in the Chevrolet Impala. Similarly, Toyota uses bio-PP for injection molded parts such as scuff plates and interior trims. The opportunities for organically derived PP are, thus, immense in the auto industry.

Packaging Segment to Dominate Market Share

On the basis of application, the market has been segregated into building & construction, consumer goods, packaging, and others. Among these, the packaging segment dominated the market in 2020 and will retain its commanding position due to the increasing demand for eco-friendly packaging materials from the food & beverage industry. The automotive segment is also anticipated to enlarge its share of 12.32% in the global market and a share of 11.83% in the Germany market in the forthcoming years.

By region, this market has been grouped into North America, Europe, Asia Pacific, and the Rest of the World.

Europe Market Registers USD 29.7 Million in Value in 2020

- Among regions, Europe is forecasted to lead the bio-based polypropylene market share on account of the growing adoption of naturally derived polymers in the region’s robust auto sector. This adoption trend is also fuelled by the EU’s commitment to becoming carbon neutral within the next couple of decades. In 2020, the Europe market size stood at USD 29.7 million.

- The booming demand for individual passenger cars in developing nations will foster enduring growth of the market in Asia Pacific.

- In Brazil, rapid urbanization and the sterling growth of the domestic consumer goods industry will propel the demand for bio-based polypropylene in Latin America.

Information Source: https://www.fortunebusinessinsights.com/bio-based-polypropylene-market-102758

Strategic Partnerships to Enable Key Players to Expand Geographic Presence

Key players in this market are strategically partnering with different companies in a bid to expand their presence and operations across diverse geographies. Moreover, companies are also making heavy investments in research & development activities to create inventive bio-PP solutions and widen their business horizons, both regionally and internationally.

Industry Development

- March 2023: Borealis started production of polypropylene based on Neste-produced renewable feedstock at the production facilities in Kallo and Beringen, Belgium. Borealis has replaced fossil fuel-based feedstock in large-scale commercial production of PP.

- June 2019: LyondellBasell, a producer of plastics, and Neste, the producer of renewable diesel from waste and residues, announced the parallel production of bio-PP and bio-based low-density polyethylene at a commercial scale. The joint project used Neste’s renewable hydrocarbons derived from sustainable bio-based raw materials, such as waste and residue oils.