Plastic Containers Market: Growth, Trends & Future Outlook

According to Fortune Business Insights, The global plastic containers market is expanding rapidly, driven by rising demand from food & beverages, pharmaceuticals, cosmetics, and FMCG sectors. The market was valued at USD 218.04 billion in 2024 and is projected to reach USD 420.97 billion by 2035, growing at a CAGR of 6.2% from 2025-2035.

Market Overview

Plastic containers are widely used due to their durability, lightweight structure, ease of moulding, and cost-effectiveness. Common materials include PET, PP, HDPE, LDPE, and others, which are processed into bottles, jars, tubs, pails, cups, and various container types.

Key advantages driving their adoption:

Cost-effective alternative to glass and metal

Strong presence across beverages, food, FMCG, personal care, and healthcare

Rapid growth in developing economies with rising packaged goods consumption

Download Free Sample: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/plastic-containers-market-102372

Market Drivers

1. Rising Food & Beverage Consumption

The food and beverage industry remains the biggest consumer of plastic containers. PET bottles dominate due to their transparency, lightweight nature, and excellent barrier properties.

2. Growth in Cosmetics & Personal Care

Cosmetic and personal care brands increasingly prefer PP and HDPE bottles and jars due to hygiene, leak resistance, and portability.

3. Asia-Pacific Dominance

Asia-Pacific led the market in 2024 with a 47.40% share, supported by booming beverage consumption and the expansion of FMCG and packaging facilities.

Segment Insights

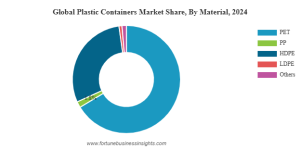

By Material

PET holds the largest market share thanks to strength, clarity, and recyclability.

HDPE is widely used in household chemicals, personal care, and food packaging due to its impact resistance.

By Container Type

Bottles & Jars are the fastest-growing container type, driven by high demand in beverages, pharmaceuticals, and food industries.

By End-Use Industry

Beverages dominate the end-use segment, especially bottled water, juices, dairy drinks, and soft drinks.

Pharmaceuticals & Cosmetics are also growing as plastic containers provide excellent chemical resistance and convenience.

Regional Analysis

Asia-Pacific

Market size reached USD 103.36 billion in 2024.

Driven by beverage industry expansion, rising incomes, and increasing packaged food consumption.

North America

Estimated to reach USD 39.82 billion in 2025, led by high consumption of beverages, household products, and personal care goods.

Europe

Expected to grow at 5.8% CAGR and reach USD 43.02 billion in 2025, supported by FMCG and growing sustainability initiatives.

Latin America & Middle East/Africa

Moderate growth with rising demand for packaged goods;

Saudi Arabia expected to reach USD 12.73 billion in 2025.

Challenges

Sustainability & Regulatory Pressure: New global and regional rules require higher recyclability and minimum recycled content.

Competition from Alternative Materials: Aluminium and paper packaging are growing due to their strong recycling performance.

Opportunities

Growth in Post-Consumer Recycled (PCR) Plastics such as rPET and PCR-HDPE

Premium & Innovative Packaging Designs for cosmetics, personal care, and pharmaceuticals

High potential for circular economy investments across major markets

LIST OF KEY PLASTIC CONTAINERS COMPANIES PROFILED

- ALPLA (Austria)

- Pretium Packaging (U.S.)

- Amcor Plc (Switzerland)

- Plastipak Packaging (U.S.)

- Graham Packaging (U.S.)

- Winpak LTD. (Canada)

- Greiner Packaging (Austria)

- Huhtamaki (Finland)

- Visy (Australia)

- Zhuhai Zhongfu Industrial Co., Ltd (China)

- Polycon Industries, Inc. (U.S.)

- W. Plastics (U.S.)

- Silgan Holdings, Inc. (U.S.)

Competitive Landscape

The market is moderately fragmented with companies focusing on innovation, recycled materials, and mergers & acquisitions. Leading players include global packaging manufacturers producing PET bottles, HDPE containers, jars, and customizable packaging solutions for food, pharma, and household goods.

The plastic containers market is set for strong expansion over the next decade, supported by growth in key industries, increasing urbanization, and the shift toward lightweight, sustainable packaging. Companies investing in recyclable materials, PCR integration, and smart packaging technologies will gain significant competitive advantage.

Information Source: https://www.fortunebusinessinsights.com/plastic-containers-market-102372

KEY INDUSTRY DEVELOPMENTS

- May 2025 – Amcor finalized its all-stock merger with Berry Global, creating an expanded consumer and healthcare packaging leader with broader material science capabilities, innovation scale, and operational synergies that deliver USD 650 million in annual cost and growth benefits.

- October 2024 – Silgan Holdings Inc. completed the acquisition of Weener Plastics, strengthening its position in sustainable rigid packaging and differentiated dispensing solutions for personal care, food, and healthcare. The integration enhances Silgan’s global footprint and technology capabilities, reinforcing its market leadership in plastic closures and custom packaging.

Trending SEO FAQs

What is the size of the plastic containers market in 2024?

The market size reached USD 218.04 billion in 2024.What is the expected CAGR of the plastic containers market?

The market is projected to grow at 6.2% CAGR from 2025–2035.Which material dominates the plastic containers market?

PET is the leading material segment.Which end-use industry uses the most plastic containers?

The beverage industry is the largest consumer.Which region leads the global plastic containers market?

Asia-Pacific holds the largest market share.