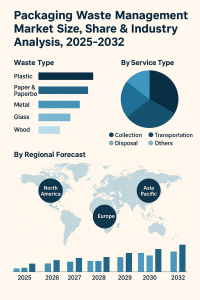

According to Fortune Business Insights, The global packaging waste management market was valued at USD 92.19 billion in 2024 and is expected to grow to USD 96.53 billion in 2025, reaching USD 137.15 billion by 2032. This growth represents a CAGR of 5.15% over the forecast period. In 2024, Asia Pacific led the market, accounting for 31.45% of the total share.

The packaging waste management market covers the collection, sorting, recycling, recovery (including waste-to-energy), and safe disposal of post-consumer and post-industrial packaging materials such as paper & board, plastics, glass, metals, and bioplastics. Demand is being reshaped by circular-economy policies, brand-owner sustainability targets, and rapid growth in e-commerce that changes both the volume and composition of packaging waste. Across regions, governments are tightening regulations (EPR, landfill taxes, deposit return systems), while technology providers are scaling advanced sorting and chemical recycling to increase recovery rates and material quality.

Request a FREE Sample Copy: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/packaging-waste-management-market-112352

List of the Key Companies Profiled in the Report:

- Waste Mission (U.K.)

- BEWI (Austria)

- Frigorifico Allana Pvt. Ltd. (Austria)

- Bayer AG (Austria)

- ITENE (Austria)

- Merivaara Corporation (Austria)

- Greenbank Recycling Solutions (U.K.)

- Stevcon Packaging & Logistics Ltd (Austria)

- JBS (Austria)

- WM Intellectual Property Holdings, L.L.C. (U.S.)

- PreZero International (Austria)

- Affordable Waste Management Ltd. (Austria)

Key Market Drivers

Policy pressure & EPR: Extended Producer Responsibility (EPR) schemes shift end-of-life costs to producers, accelerating design-for-recycling and funding for collection/sorting infrastructure.

Corporate sustainability targets: FMCG, retail, and consumer brands are committing to higher recycled content and 100% recyclable packaging—creating stable demand for high-quality recyclate.

Surge in e-commerce: More secondary and tertiary packaging (corrugated, flexible plastics) increases volumes and complexity, pushing cities and haulers to adapt collection models.

Landfill/incineration constraints: Rising tipping fees and landfill scarcity in many markets make recovery more economical and politically favored.

Market Challenges

Economics of recycling: Volatile commodity prices and quality variability can make recycled feedstock less competitive versus virgin materials without policy support.

Collection & contamination: Mixed waste streams and low participation rates undermine material value and plant efficiency.

Fragmented regulations: Divergent rules across countries (and even states) complicate compliance for global brands and recyclers.

Difficult-to-recycle formats: Multi-layer films, dark plastics, and small-format items still pose technical and economic hurdles.

Market Segmentation

By Material

Paper & Paperboard

Plastics (PET, HDPE, LDPE/LLDPE, PP, PS, PVC, multi-layer/films)

Glass

Metals (Aluminum, Steel)

Bioplastics/Compostables

By Source

Residential (municipal)

Commercial & Industrial (retail, foodservice, manufacturing, logistics)

By Service

Collection & Transportation

Sorting/Material Recovery (MRF operations)

Recycling & Reprocessing (mechanical and chemical)

Energy Recovery (RDF, waste-to-energy)

Landfill & Other Disposal

Consulting & Compliance (EPR, ESG reporting)

By End Use of Recyclate

Food & Beverage Packaging

Personal Care & Household

Industrial & Logistics (pallets, straps, films)

Construction & Automotive (downstream uses for fibers, glass cullet, metals)

By Region

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

Regulatory Landscape (What’s Shaping Demand)

EPR & Packaging Taxes: Funding for collection and MRF upgrades; eco-modulated fees reward recyclable designs.

Deposit Return Systems (DRS): Raising PET, aluminum, and glass return rates and improving quality (low contamination).

Recycled Content Mandates: Minimum rPET/rHDPE content for beverage bottles and certain rigid/film applications.

Green Claims & Traceability: Stricter substantiation requirements drive investment in chain-of-custody and mass-balance systems.

Technology & Innovation Trends

AI-enabled sorting & robotics: Higher throughput, lower labor dependency, and improved purity levels.

Digital watermarks & markers: Enhancing identification of packaging types at MRF speed.

Chemical recycling (pyrolysis, depolymerization, solvent-based): Targeting hard-to-recycle plastics to yield near-virgin monomers.

Advanced washing & de-inking: Upgrading recyclate quality for food-grade and high-performance use.

Closed-loop & reuse systems: Refillable packaging, reverse logistics, and durable containers for e-commerce and foodservice.

Biodegradable/compostable packaging: Scaling in targeted applications with appropriate organics collection and composting infrastructure.

Competitive Landscape

The market features a mix of global and regional players across the value chain:

Waste management & MRF operators: Waste Management, Republic Services, Veolia, SUEZ, REMONDIS, Biffa.

Technology & equipment providers: TOMRA, Pellenc ST, AMP Robotics (AI/robotics), Bollegraaf, Stadler (MRF lines).

Recyclers & reprocessors: Indorama Ventures (PET), ALPLA Recycling, Evergreen/CarbonLITE (rPET), Novelis (aluminum), Ardagh (glass).

Energy recovery & WtE: Covanta, EEW Energy from Waste.

Compliance & EPR organizations: PROs and stewardship bodies partnering with municipalities and brands.

Strategic Opportunities for Stakeholders

Design for recycling: Shift to mono-materials, eliminate problem additives, standardize labels (e.g., “widely recyclable”).

Invest in high-purity streams: DRS and curbside upgrades that deliver food-grade PET/HDPE and high-quality OCC.

Flexible packaging solutions: Scale film collection pilots, store drop-off, and chemical recycling feedstock supply.

Data & traceability: Implement digital product passports, batch-level analytics, and verifiable recycled content accounting.

Reuse ecosystems: Target high-frequency, closed environments (stadiums, campuses, QSR chains) to prove economics.

Outlook (2025–2032)

Higher recovery, better quality: Expect steady increases in PET, aluminum, and OCC capture; focus shifts to films and flexible plastics.

Policy-driven investment: EPR and recycled-content mandates sustain capex in MRF modernization, advanced reprocessing, and DRS expansion.

Consolidation & specialization: Larger operators acquire niche recyclers (e.g., films, food-grade PCR), while equipment makers bundle AI, robotics, and optical sorting as turnkey solutions.

Balanced portfolio of solutions: Mechanical recycling remains the backbone; chemical recycling scales selectively where economics and policy align; reuse systems grow in targeted channels.

Emerging markets leapfrog: With EPR funding and digital tools, APAC and parts of LATAM/MEA accelerate from low baselines to modernized systems.

Information Source: https://www.fortunebusinessinsights.com/packaging-waste-management-market-112352

KEY INDUSTRY DEVELOPMENTS

In December 2024, Bisleri International Pvt. Ltd, in collaboration with Sampurn(e)arth Environment Solutions Pvt. Ltd. and the Mineral Foundation of Goa, launches a Material Recovery Facility (MRF) Center in Harvalem, Goa. The facility is designed to handle 360 MT of plastic waste each year. Bisleri’s ‘Bottles for Change’ program seeks to reduce plastic waste in landfills and foster a cleaner, more sustainable ecosystem in the area. The facility will mostly focus on promoting 100% plastic waste separation at the source, beginning with the Curchorem-Cacora area.

In October 2024, At the PPMA Show, Waste Mission, a prominent UK waste management firm, introduced its tailor-made Waste Management Portal. This cutting-edge platform is tailored exclusively for contracted clients, allowing them to handle their waste more efficiently and sustainably than ever while keeping them informed about waste streams, compliance, and ESG goals.