Introduction: Why Payroll Accuracy is Critical in HR

In today’s competitive business environment, payroll is more than just a monthly transaction — it’s the lifeline of employee satisfaction, legal compliance, and financial accuracy. When payroll is managed efficiently, employees are paid on time, taxes are filed correctly, and the organisation stays compliant with government regulations. However, inaccuracies in payroll processing can lead to financial losses, compliance penalties, and even legal disputes.

For HR departments, ensuring payroll accuracy is not just a responsibility — it’s a strategic priority. With the growing complexity of labor laws and tax regulations in India, companies are increasingly turning to HR Payroll Software to automate calculations, streamline compliance, and reduce human error.

Understanding Payroll Processing in HR

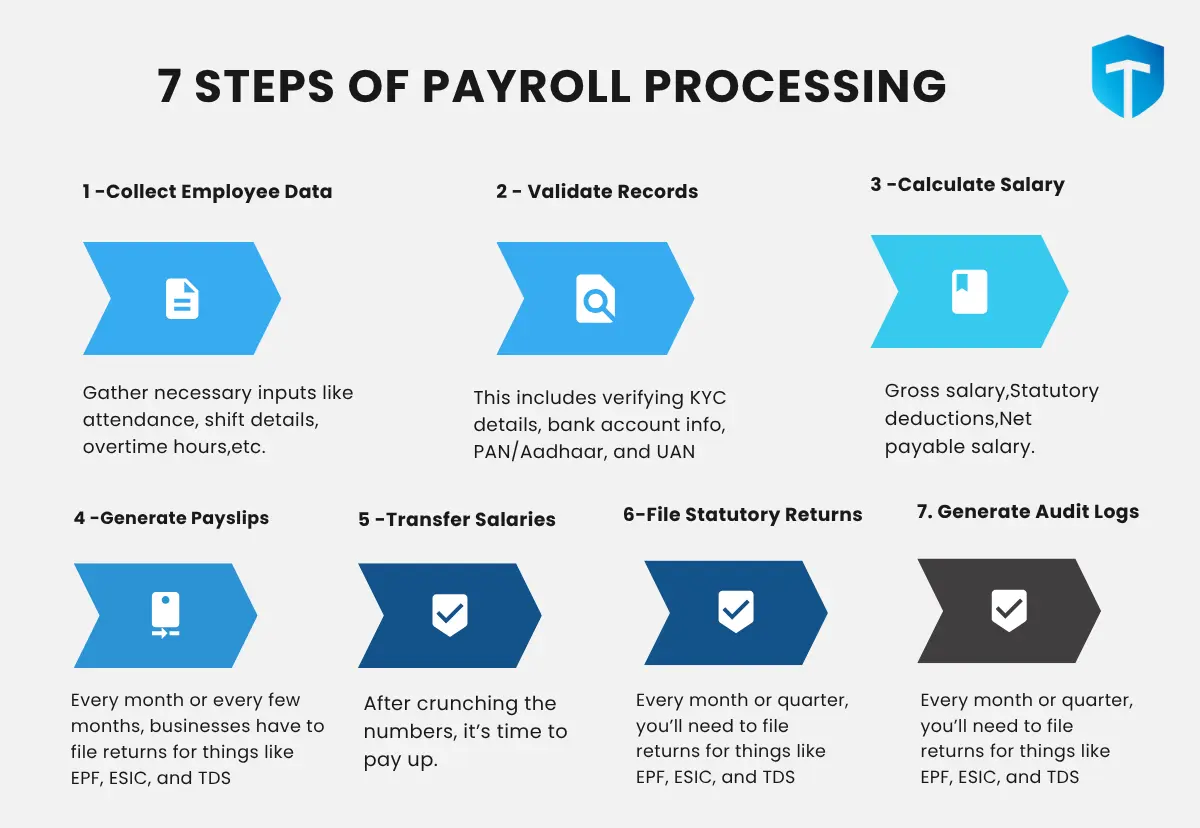

Payroll processing in HR is the systematic procedure of collecting employee work data, calculating gross and net salaries, deducting statutory contributions, generating payslips, and disbursing payments. It also involves filing taxes and maintaining accurate payroll records for audits.

A typical payroll process in HR includes:

- Data Collection – Attendance, leave records, overtime hours, and other work-related inputs.

- Salary Calculation – Applying salary structures, allowances, bonuses, and deductions.

- Tax & Compliance Deductions – EPF, ESI, Professional Tax, Income Tax (TDS), and other contributions.

- Payment Processing – Transferring salaries to employee bank accounts.

- Record Keeping & Reporting – Maintaining payroll records for audits and compliance.

In India, Payroll Management Software is often integrated with HRMS (Human Resource Management Systems) to ensure smooth operations and minimal errors.

Common Errors in Manual Payroll

Manual payroll processing is prone to mistakes, even with the most experienced HR staff. Some common payroll errors include:

- Incorrect Data Entry – Typing errors in salaries, deductions, or attendance.

- Misclassification of Employees – Incorrect categorisation of full-time, part-time, and contractual workers leading to wrong tax calculations.

- Overtime Miscalculations – Paying less or more due to inaccurate time tracking.

- Missed Compliance Deadlines – Late tax filings or failure to submit statutory reports.

- Wrong Benefit Deductions – Incorrect calculation of PF, ESI, or leave encashment.

Even a small payroll error can damage employee trust, cause legal trouble, and increase administrative workload.

How Payroll Automation Boosts Accuracy

The shift from manual to automated payroll processing has revolutionised HR functions. HR Payroll Software automates calculations, applies compliance rules, and processes payments without manual intervention, reducing the risk of human error.

Key benefits of payroll automation include:

- Error-Free Calculations – Automatic application of salary structures, deductions, and allowances.

- Real-Time Compliance Updates – Software updates tax rates and legal requirements automatically.

- Seamless Data Integration – Attendance, leave, and performance data synced with payroll.

- Quick Processing – Payroll cycles completed in hours instead of days.

- Audit-Ready Reports – Instant generation of compliance and salary reports.

By implementing Payroll Software in India, companies can not only improve accuracy but also create a transparent payroll experience for employees.

Compliance Risks in Payroll

Payroll compliance in India involves adhering to multiple statutory requirements such as:

- Employees’ Provident Fund (EPF)

- Employees’ State Insurance (ESI)

- Professional Tax (PT)

- Income Tax (TDS)

- Labour Welfare Fund (LWF)

Failure to comply with these regulations can lead to:

- Heavy financial penalties

- Legal notices and disputes

- Loss of company reputation

For example, a delay in EPF filing can attract a penalty of 12% interest per annum along with administrative charges. Using Top Payroll Software in India helps businesses avoid such compliance risks by automating tax filing and generating accurate statutory reports.

HR’s Role in Ensuring Legal Compliance

While technology plays a big role in payroll accuracy, HR teams remain the guardians of compliance. Their responsibilities include:

- Keeping updated with changes in labor laws and tax regulations.

- Verifying payroll data before processing.

- Coordinating with finance teams for accurate disbursement.

- Conducting internal payroll audits.

- Managing employee queries related to salaries and deductions.

With the help of Payroll Management Software, HR professionals can focus on strategic workforce planning instead of getting bogged down by repetitive payroll tasks.

Best Practices for Payroll Accuracy

To ensure payroll accuracy and compliance, businesses should follow these best practices:

- Centralise Employee Data – Use an integrated HRMS to maintain consistent and updated information.

- Automate Payroll Processes – Reduce manual intervention and human errors.

- Regular Compliance Checks – Keep track of changes in tax laws and labor regulations.

- Train HR Teams – Provide regular training on payroll laws and software usage.

- Maintain Backup Records – Store payroll data securely for audit and legal purposes.

Following these steps can drastically reduce payroll errors and ensure smooth operations.

Top Payroll Software for Compliance in India

Several Best Payroll Software in India options are available that cater to different business sizes and needs. Here are some top choices:

| Software Name | Key Features | Best For |

| TankhaPay | EPF/ESI automation, compliance management, payslip generation | Businesses of all sizes |

| GreytHR | Leave & attendance integration, tax filing | SMEs and startups |

| Keka | HRMS integration, employee self-service | Mid-size businesses |

| Zoho Payroll | Cloud-based payroll, automated tax calculation | Small to mid-sized companies |

| ADP India | Global compliance support, scalable payroll | Large enterprises |

Choosing the Best Payroll Service in Delhi or any other region depends on your business size, compliance needs, and integration requirements.

Case Study: A Company that Improved Payroll Accuracy

Company: A mid-sized IT services firm in Bangalore with 350 employees.

Challenge:

The HR team struggled with manual payroll processing, leading to frequent salary delays, incorrect deductions, and missed compliance deadlines.

Solution:

The company implemented TankhaPay Payroll Software in India, which automated their salary calculations, tax filings, and statutory compliance reports.

Results:

- Payroll cycle time reduced from 5 days to 5 hours.

- Zero compliance penalties in the first year.

- 98% reduction in payroll-related employee complaints.

- Increased HR efficiency, allowing the team to focus on talent management.

Conclusion & Key Takeaways

Payroll processing in HR is a critical business function that directly impacts employee satisfaction and legal compliance. Manual processes are prone to errors, which can lead to financial losses and reputational damage.

By adopting HR Payroll Software and following best practices, companies can:

- Achieve higher payroll accuracy

- Ensure compliance with statutory regulations

- Improve employee trust and transparency

- Save time and operational costs

In India’s rapidly evolving business landscape, investing in Payroll Management Software is not just a tech upgrade — it’s a strategic move towards sustainable growth. Whether you’re looking for the Best Payroll Software or the Top Payroll Software in India, choosing the right solution can safeguard your business against compliance risks and keep your workforce motivated.