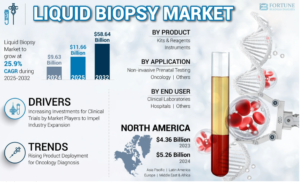

The global liquid biopsy market was valued at USD 9.63 billion in 2024 and is expected to grow from USD 11.66 billion in 2025 to USD 58.64 billion by 2032, registering a CAGR of 25.9% during the forecast period. In 2024, North America led the global liquid biopsy market, accounting for a 54.43% share.

The liquid biopsy market is emerging as a transformative tool in cancer diagnostics and monitoring. It enables the detection of tumor-derived materials such as circulating tumor DNA (ctDNA), exosomes, and circulating tumor cells (CTCs) through a non-invasive blood draw. This technology offers significant advantages over traditional tissue biopsies, including real-time disease tracking, early detection, and treatment response assessment. Growing demand for personalized medicine, increasing cancer prevalence, and advancements in next-generation sequencing technologies are key factors driving the expansion of the global liquid biopsy market.

Continue reading for more details:

https://www.fortunebusinessinsights.com/liquid-biopsy-market-102506

Liquid Biopsy Market Overview & Key Metrics

Market Size & Forecast

- The global liquid biopsy market was valued at USD 9.63 billion in 2024, with growth expected to reach USD 11.66 billion in 2025.

- By 2032, the market is projected to surge to USD 58.64 billion, registering a strong CAGR of 25.9% from 2025 to 2032.

- This growth is fueled by increasing demand for non-invasive cancer diagnostics, early screening solutions, and advancements in molecular testing technologies.

Market Share

- By Region:

- North America led the global liquid biopsy market in 2024 with a 43% share, supported by:

- Rapid adoption of precision oncology tools.

- Robust innovation pipelines from major diagnostic companies.

- Favorable reimbursement policies across the U.S. and Canada.

- By Product:

- Kits & reagents held the largest market share in 2024, driven by:

- Frequent product approvals for circulating tumor DNA (ctDNA) and non-invasive prenatal testing (NIPT).

- Companies like Illumina, Guardant Health, and Foundation Medicine expanding their assay portfolios to offer high-sensitivity, fast-turnaround solutions.

Key Country Highlights

- United States:

- Leads the market with significant R&D investments and widespread adoption of liquid biopsy technologies.

- The approval of assays like Guardant360 CDx for non-small cell lung cancer (NSCLC) reflects FDA support for advanced oncology diagnostics.

- Post-COVID trends have driven increased use of at-home cancer testing solutions.

- India:

- Rising cancer cases—from 1.39 million in 2020 to 1.46 million in 2022—are creating a stronger need for early detection.

- Government initiatives and data from ICMR are supporting broader adoption of NIPT and oncology screening, especially in urban healthcare settings.

- China:

- Market growth is propelled by increased investment in genetic testing infrastructure and a rapidly aging population.

- Expansion of molecular diagnostic laboratories and local biotech innovation is improving accessibility for oncology and prenatal liquid biopsy tests.

- Europe:

- Growth is supported by strong regulatory frameworks and government-backed cancer screening programs.

- The U.K.’s NHS has launched early detection initiatives using liquid biopsy, while countries like Germany and France are expanding national NIPT coverage.

- Companies such as Dxcover Ltd. are receiving public funding to develop next-generation diagnostic platforms.

- Japan:

- Demand is rising due to an aging population and national strategies for early cancer and genetic disorder detection.

- Hospitals across Japan are increasingly adopting NGS-based liquid biopsy for both prenatal and oncology applications, supported by government policies promoting precision medicine.

Market Segmentation

- By Technology: ctDNA assays, CTC-based tests, exosomal biomarker platforms, and other novel molecular detection techniques in the liquid biopsy market.

- By Application: early cancer detection, disease monitoring, therapy response assessment, minimal residual disease (MRD) tracking, and companion diagnostics under the umbrella of the liquid biopsy market.

- By Cancer Type: lung cancer, breast cancer, colorectal cancer, prostate cancer, and other oncology indications within the liquid biopsy market.

- By End User: diagnostic laboratories, hospitals, oncology clinics, research institutions, and pharmaceutical partners in the liquid biopsy market.

- By Geography: segmentation into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa within the liquid biopsy market.

Key Companies Featured in the Liquid Biopsy Market Report:

- Guardant Health (U.S.)

- PERSONALIS, INC. (U.S.)

- FOUNDATION MEDICINE, INC. (U.S.)

- Natera, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- Hoffmann-La Roche Ltd (Switzerland)

- Menarini Silicon Biosystems, Inc. (Italy)

- Thermo Fisher Scientific Inc. (U.S.)

- QIAGEN (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

Market Growth:

The liquid biopsy market is experiencing rapid growth due to its potential to transform oncology care. It offers a less invasive, quicker, and repeatable alternative for tumor profiling, treatment selection, and disease monitoring. The integration of liquid biopsy into clinical workflows is expanding as oncologists seek to enhance patient outcomes with more precise and timely diagnostics. Continued advancements in genomic technologies, next-generation sequencing (NGS), and biomarker discovery are further fueling the market’s expansion.

Restraining Factors

- High cost of testing and limited reimbursement in certain regions may restrain adoption in the liquid biopsy market.

- Variability in analytical sensitivity and clinical validation across platforms poses challenges in the liquid biopsy market.

- Regulatory hurdles and lack of standardized protocols can delay broader commercialization of liquid biopsy market technologies.

- Limited awareness among healthcare providers and oncologists may slow clinical uptake of the liquid biopsy market.

- Fragmented testing infrastructure and limited access in emerging markets can hinder expansion of the liquid biopsy market.

Regional Analysis

- North America: Leads the liquid biopsy market with established diagnostic infrastructure, widespread cancer screening programs, and favorable reimbursement frameworks.

- Europe: Shows robust growth in the liquid biopsy market, driven by public healthcare systems investing in early cancer detection and large-scale validation studies.

- Asia Pacific: Emerging as a high-growth region for the liquid biopsy market, aided by increasing oncology incidence, growing healthcare investment, and expanding diagnostic facilities.

- Latin America: Displays gradual adoption in the liquid biopsy market, supported by rising awareness and pilot programs in major medical centers.

- Middle East & Africa: Developing presence in the liquid biopsy market, with increasing interest in modern diagnostics and growing healthcare infrastructure investments.

Contact Us:

Fortune Business Insights™ Pvt. Ltd.

9th Floor, Icon Tower,

Baner – Mahalunge Road,

Baner, Pune-411045,

Maharashtra, India.

Phone:

U.S.: +1 424 253 0390

U.K.: +44 2071 939123

APAC: +91 744 740 1245

Email: [email protected]