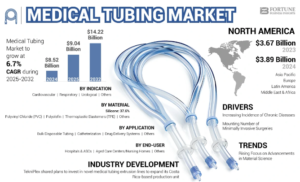

The global medical tubing market was valued at USD 8.52 billion in 2024 and is projected to grow to USD 14.22 billion by 2032, growing at a steady CAGR of 6.7%. In 2023, North America led the market with a strong 45.65% share.

The global medical tubing market is experiencing consistent growth, driven by the rising demand for advanced medical devices, increasing healthcare expenditure, and the expanding elderly population. Medical tubing plays a critical role in applications such as fluid management, drug delivery systems, and surgical procedures, with growing adoption in minimally invasive treatments further boosting demand. Technological advancements in material science, including the development of biocompatible and high-performance polymers, are enhancing product safety and functionality. North America remains a key market leader due to its well-established healthcare infrastructure and strong presence of medical device manufacturers, while Asia Pacific is emerging as a high-growth region supported by improving healthcare access and rapid industrial development.

Continue reading for more details:

https://www.fortunebusinessinsights.com/medical-tubing-market-109888

Medical Tubing Market Overview & Key Metrics

Market Size & Forecast:

- 2024 Market Size: USD 8.52 billion

- 2025 Market Size: USD 9.04 billion

- 2032 Forecast Market Size: USD 14.22 billion

- CAGR: 6.7% from 2025–2032

Market Share:

- North America dominated the medical tubing market with a 45.65% share in 2023, driven by the high incidence of cancer and chronic diseases, leading to increased demand for tubing in therapies such as intravenous delivery, tube feeding, and biomedical applications.

- By material, silicone held the largest share in 2024 due to its excellent biocompatibility, thermal stability, and chemical resistance, making it ideal for critical medical applications.

Key Country Highlights:

- Japan: Demand driven by the growing focus on minimally invasive procedures and advanced healthcare infrastructure requiring high-performance, biocompatible tubing materials.

- United States: Growth supported by a surge in cancer and chronic diseases, prompting increased adoption of tubing in drug delivery and catheterization. Regulatory compliance with FDA standards also shapes product innovation and market dynamics.

- China: Rapid healthcare infrastructure expansion, increasing disease burden, and initiatives like Belt and Road fueling demand for advanced medical tubing, especially in catheterization and drug delivery systems.

- Europe: Adoption is driven by rising cardiovascular disease prevalence, with medical tubing utilized in ventilators, intravenous fluid delivery, and surgical applications. The presence of stringent regulatory frameworks and sustainability trends also impact market growth.

List of Key Companies Profiled:

- Nordson Corporation (U.S.)

- Saint-Gobain (France)

- Freudenberg Medical (U.S.)

- The Lubrizol Corporation (U.S.)

- TE Connectivity (Switzerland)

- Elkem ASA (Norway)

- RAUMEDIC AG (U.S.)

- Teknor Apex (U.S.)

- Spectrum Plastics Group (Georgia)

Market Segmentation

- By Product Type: Includes PVC tubing, silicone tubing, polyolefin tubing, fluoropolymer tubing, and others used in various medical applications.

- By Application: Covers bulk disposable tubing, catheters & cannulas, drug delivery systems, and special applications within the medical tubing market.

- By Material: Segmented into plastics, rubbers, and specialty polymers designed for biocompatibility and performance.

- By End User: Hospitals, clinics, ambulatory surgical centers, and home healthcare providers utilize medical tubing for multiple purposes.

Market Growth

- The medical tubing market is witnessing strong expansion due to rising demand for advanced medical devices and minimally invasive surgical procedures.

- Increasing use of medical tubing in applications such as drug delivery systems, catheters, and diagnostic equipment is fueling market growth.

- Technological advancements in polymer materials and biocompatible designs are driving innovation in the medical tubing market.

- Growing healthcare infrastructure investments and aging populations are further contributing to the market’s upward trajectory.

Regional Insights:

In 2023, North America generated USD 3.67 billion, thanks largely to the rising number of cancer cases. Medical tubing is crucial in cancer care—used for feeding tubes, IVs, and other procedures. Europe came next, supported by high rates of heart failure, where tubing is needed for ventilators and fluid delivery.

Asia Pacific is expected to grow the fastest, due to better healthcare infrastructure, more healthcare spending, and growing awareness of advanced medical options. In contrast, Latin America and the Middle East & Africa are growing more slowly, but medical tourism—especially in places like Dubai and Abu Dhabi—is helping drive demand.