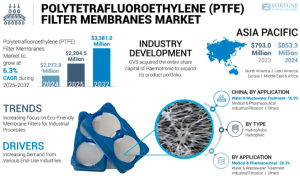

According to Fortune Business Insights, The global polytetrafluoroethylene (PTFE) filter membranes market size was valued at USD 2,073.8 million in 2024. The market is projected to grow from USD 2,204.5 million in 2025 to USD 3,381.0 million by 2032, exhibiting a CAGR of 6.3% during the forecast period. Asia Pacific dominated the polytetrafluoroethylene (PTFE) filter membranes market with a market share of 41.15% in 2024.

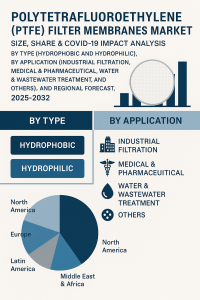

Polytetrafluoroethylene (PTFE) filter membranes are synthetic membranes used for air and liquid filtration. PTFE is classified into hydrophobic & hydrophilic type that repels water and other liquids, making it an excellent choice for filtering gases and liquids. Polytetrafluoroethylene filter membranes are often used in applications that require high chemical resistance, high temperatures, or high purity. They are commonly used in the pharmaceutical, food and beverage, and chemical industries.

Request a FREE Sample Copy: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/polytetrafluoroethylene-ptfe-filter-membranes-market-108725

LIST OF KEY COMPANIES PROFILED:

- HYUNDAI MICRO Co., Ltd. (South Korea)

- Hangzhou IPRO Membrane Technology Co., Ltd (China)

- Suzhou Unique New Material Science & Technology Co., Ltd. (China)

- Hangzhou Cobetter Filtration Equipment Co.Ltd (China)

- GVS S.p.A. (Italy)

- General Electric (U.S.)

- Pall Corporation. (U.S.)

- Corning Incorporated (U.S.)

- Donaldson Company, Inc. (U.S.)

Regional Landscape

North America dominates the current market, holding ~40% share in 2023, with projected market share around 27–28% by 2025, supported by stringent regulations such as FDA or EPA compliance standards in pharmaceutical, chemical, and wastewater sectors.

Europe also contributes 20% of the market, with growth driven by regulatory pressures such as REACH and environmental mandates.

Product Types & Segments

Hydrophobic vs Hydrophilic

Hydrophobic PTFE membranes lead the market and are expected to grow fastest—with 63.1% share by 2025—because of their superior moisture resistance, making them ideal for pharmaceutical, biotech, and industrial applications.

Hydrophilic PTFE membranes currently hold 40–60% share in some reports, reflecting their use in certain liquid‑filtration applications.

Key Industrial Applications

Industrial filtration is the dominant application area—used in chemical processing, cement, power generation, and petrochemical industries due to PTFE’s excellent chemical resistance and thermal stability.

Other sectors include water & wastewater treatment, food & beverage processing, and medical/pharmaceutical filtration, particularly for sterile venting, drug manufacturing, and biotechnology processes.

Market Drivers & Opportunities

Strict environmental and industrial regulations globally, especially in waste discharge, emissions control, and clean‑water mandates, are driving demand for high‑performance filtration systems—PTFE membranes meet these standards.

Rapid industrialization and urbanization, particularly in APAC countries (e.g., China, India), fuel demand for treated water and high‑purity filtration in chemical and pharmaceutical manufacturing.

Technological innovation—including nano‑engineering, electrospinning, development of ePTFE composites and hybrid membranes—is enhancing membrane efficiency and opening new use‑cases such as fuel cells, hydrogen separation, and biotech applications.

Challenges & Market Constraints

High manufacturing cost: PTFE-based membranes remain costlier than alternative materials (ceramic or polymeric) due to specialized processing and raw material volatility.

Regulatory compliance barriers: Multiple regional safety and environmental standards can delay product rollouts and raise entry costs for new players.

Emerging competition: Substitute technologies and materials—such as ceramic membranes or alternative fluoropolymers—pose pressure, particularly in price-sensitive market segments.

Competitive Landscape

Leading players include Pall Corporation, Saint‑Gobain, Corning, Donaldson Company, W. L. Gore & Associates, Fiberflon, Hawach Scientific, Merck KGaA, Cytiva, and Hyundai Micro Co., among others.

Recent moves: Merck expanded PTFE membrane capacity in Ireland (~€440M investment) and Pall launched new hydrophobic PTFE lines targeting high-purity pharmaceutical and medical filtration markets in 2022–2023.

Forecast Outlook (2025–2035)

APAC remains the fastest expanding region, with China and India leading in demand; North America and Europe sustain growth through regulatory and infrastructure-driven opportunities.

Hydrophobic PTFE membranes take an increasingly larger market share due to advances in performance and increasing penetration in pharma, biotech, and industrial filtration.

Information Source: https://www.fortunebusinessinsights.com/polytetrafluoroethylene-ptfe-filter-membranes-market-108725

KEY INDUSTRY DEVELOPMENTS:

- In February 2023, Donaldson Company, Inc. acquired Isolere Bio, Inc., a biotechnology company known for developing IsoTag reagents and its filtration processes, which are commonly used in manufacturing biopharmaceuticals. This acquisition is expected to expand Donaldson Company’s capabilities while streamlining its manufacturing processes.

- In May 2022, GVS announced the acquisition of the entire share capital of Haemotronic, a prominent Italian group specializing in producing advanced filtration solutions for highly critical applications. In addition, Haemotronic is a leading manufacturer of medical components and bags, with plants in Italy and Mexico. This acquisition represents a significant acquisition of this company and will help it expand its product portfolio. It will also help the company strengthen its presence in the healthcare sector in both Europe and North America.