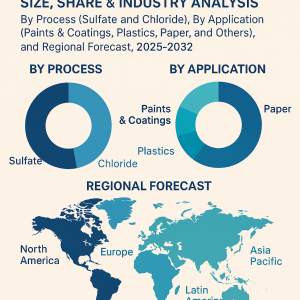

The global titanium dioxide market size was valued at USD 22.28 billion in 2024. The market is projected to grow from USD 24.81 billion in 2025 to USD 40.07 billion by 2032 at a CAGR of 7.1% during the 2025-2032 forecast period. Asia Pacific dominated the titanium dioxide market with a market share of 53.95% in 2024, observes Fortune Business Insights™ in its report, titled, “Titanium dioxide Market Size, Share & Industry Impact Analysis, By Process (Sulfate, and Chloride), By Application (Paints & coatings, Plastics, Paper, and Others), and Regional Forecast, 2025-2032.”

Titanium Dioxide (TiO₂) is a white, powdered inorganic compound renowned for its exceptional brightness and high refractive index, making it a widely used white pigment. It finds extensive applications across various industrial and consumer sectors, such as paints and coatings, plastics, cosmetics, paper, textiles, and food colorants. In the construction and automotive industries, TiO₂ plays a critical role as a primary pigment in paints and coatings used for roofing materials, flooring, automotive finishes, and printing inks.

Request a FREE Sample Copy:https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/titanium-dioxide-tio2-market-102390

A List of Key Manufacturers Operating In the Global Market:

- Tronox Holdings plc (Connecticut, U.S.)

- The Chemours Company (Delaware, U.S.)

- Argex Titanium Inc. (Québec, Canada)

- Evonik Industries (Essen, Germany)

- The Kish Company, Inc. (Ohio, U.S.)

- Ishihara Sangyo Kaisha Ltd. (Osaka, Japan)

- Venator Materials PLC. (Texas, U.S.)

- Tayca Corporation (Osaka, Japan)

- Huntsman Corporation (Texas, U.S.)

- NL Industries, Inc. (Texas, U.S.)

- INEOS (Maryland, U.S.)

- Others

Highlights of the Report:

The report includes a detailed company profile of key players and in-depth analysis of various market segments. It also includes close study of the various drivers and restraints that drive the market along with comprehensive understanding of the positive and negative impacts of regional developments on the market.

Drivers & Restraints-

Increasing Demand for Light-weight Vehicles to Drive Growth

According to the Office of Energy Efficiency and Renewable Energy, by reducing the weight of the vehicle by 10%, its fuel efficiency can be enhanced by 6%-8%. Stringent regulations from governments across the world regarding emission are driving manufacturers to adopt lightweight materials and components, such as alloys and polymer composite, for making fuel-efficient vehicles. This is projected to spur the growth of the global market. In addition, growing applications of the material in the construction industry is anticipated to further enhance growth. However, the evident decrease in the supply of titanium dioxide owing to the prolonged shutdown of production units is anticipated to hinder its growth.

Segment-

Extensive Utilization in Automobile Space to Help Paints and Coatings Segment Flourish

On the basis of application, the paints and coatings segment dominated the by holding the largest share in 2019. This is attributed to increasing application in automobiles and growing construction activities. The plastics segment showed impressive growth by holding 26.09% share of the market.

Regional Insights-

Rising Demand for Titanium dioxide from End-user Industries to Aid Growth in Asia Pacific

Asia Pacific is estimated to dominate the global titanium dioxide market with a share of USD 7,575.7 million in 2019. Rising demand for the chemical compound from various end-use industries in the region including automobile, construction, plastic, and papers is one of the major factors driving the growth of this market. In addition, improving economic stability in major countries of the region including India and China and the resultant expenditure on infrastructure are increasing the demand from the construction industry.

The market in North America is anticipated to grow potentially in the projected timeline. The increasing technological advancement in the construction space coupled with the high disposable income of consumers is expected to enhance the growth of titanium dioxide in the region.

Information Source: https://www.fortunebusinessinsights.com/titanium-dioxide-tio2-market-102390

Competitive Landscape-

Business Expansion to Help Key Players Gain Competitive Edge

Key players operating in the global titanium dioxide market comprise manufacturers and developers that are currently focused on business expansion. For example, DuPont recently improved its production capacity in order to gain competitive advantage over other players. The company constructed a new plant to produce TiO2 in Mexico and upgraded the existing one.

Industry Developments-

- December 2024: Chemours plans to expand its DeLisle plant through a partnership with PCC Group, which will build a chlor-alkali facility to ensure a steady chlorine supply for titanium dioxide production. With a 340,000 metric ton capacity, the facility aims to enhance efficiency and reduce costs. The construction is set to begin in 2026, reinforcing Chemours’ 45-year commitment to the region.

- July 2024: Kronos Worldwide, Inc. has taken full ownership of Louisiana Pigment Company (LPC), boosting its North American market position with LPC’s 156,000 metric tons of annual titanium dioxide production capacity and diversified product offerings.