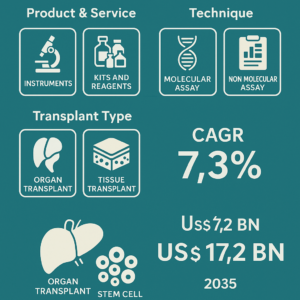

The field of transplantation has made remarkable strides in recent decades, and at the core of this progress lies a critical component—transplant diagnostics. These are the tests and technologies that ensure successful donor-recipient matches and monitor post-transplant health. According to the latest data, the global transplant diagnostics market, valued at US$ 7.8 billion in 2024, is set to more than double by 2035, reaching US$ 17.2 billion, driven by a compound annual growth rate (CAGR) of 7.3%.

Shifting Demographics and Technological Progress Fueling Market Growth

A confluence of factors is accelerating the demand for transplant diagnostics. Increasing prevalence of chronic illnesses, longer life expectancies, and an aging global population are pushing the need for organ and tissue transplants. Simultaneously, advancements in molecular diagnostics, biomarker discovery, and genetic testing are making it possible to match donors and recipients with unprecedented accuracy.

Government policies and regulatory support are also instrumental. Public health agencies and NGOs are launching campaigns that promote organ donation and demystify transplant myths, leading to a larger donor pool. The need for reliable diagnostics to ensure compatibility, reduce rejection risks, and monitor transplant health post-surgery has never been more pressing.

Market Dynamics: What’s Driving the Surge in Demand?

- Rising Organ Transplant Volumes

With transplant programs expanding worldwide, especially in developing nations, transplant procedures are becoming more common. In the U.S., for example, 48,149 organ transplants were performed in 2024, representing a 3.3% year-over-year increase. As transplant volumes rise, so does the demand for reliable diagnostics that minimize risk and enhance outcomes. Physicians are relying more on molecular tools to evaluate compatibility, track immune responses, and predict long-term transplant success.

- Growing Public Awareness and Donor Registrations

Awareness campaigns and social media outreach have played a pivotal role in encouraging organ donation. As more individuals enroll as donors, hospitals and transplant centers are experiencing higher patient flow, making diagnostics indispensable. The rise of digital health platforms and storytelling via online channels have humanized the process of donation and transplantation, creating a positive feedback loop of increased registrations and diagnostic demand.

Market Segmentation Highlights

Kits and Reagents Take the Lead

The kits and reagents segment dominates the global transplant diagnostics market, owing to their frequent use in testing processes, particularly HLA typing, cross-matching, and immunologic profiling. These products are essential for hospitals and labs to quickly and accurately assess compatibility. Their rising use in pre-transplant screening has made them the largest contributor to overall market revenue.

Molecular Assays: The Backbone of Precision Diagnostics

Molecular assays hold a majority market share due to their precision, speed, and sensitivity. Technologies such as polymerase chain reaction (PCR) and next-generation sequencing (NGS) allow clinicians to detect even the smallest immunological differences. These assays are also used for infectious disease screening in potential donors and recipients—an essential step in preventing complications.

Regional Insights: North America at the Forefront

North America is the dominant region in the transplant diagnostics space, led by the U.S. This can be attributed to its advanced healthcare infrastructure, strong R&D investments, and a high number of transplant procedures annually. The presence of major players such as Thermo Fisher Scientific, Abbott, and QIAGEN ensures that innovative diagnostic tools are widely available and continuously improved. Stringent regulatory standards in the region further reinforce the use of advanced diagnostics to ensure patient safety and transplant success.

Emerging Technologies and Industry Innovations

The field of transplant diagnostics is being reshaped by new technologies like artificial intelligence (AI) and machine learning, which are improving lab workflows, enhancing data interpretation, and aiding predictive analysis. These tools are enabling a transition from traditional diagnostics to personalized transplant medicine, where treatments and monitoring strategies are tailored to each patient’s genetic and immunological profile.

Recent developments highlight the industry’s focus on innovation. For example, QIAGEN’s update to its EZ2 Connect platform allows automated processing of cfDNA from plasma and urine—supporting non-invasive biopsy techniques. Thermo Fisher’s new risk assessment assay offers clinicians insights into acute rejection risks before the transplant, aiding personalized immunosuppressive therapy planning.

Key Players Shaping the Market

Prominent companies include:

- Abbott

- QIAGEN N.V.

- Thermo Fisher Scientific

- F. Hoffmann-La Roche Ltd.

- Bio-Rad Laboratories

- Illumina, Inc.

- Siemens Healthineers

These companies are actively pursuing strategic collaborations, expanding into emerging markets, and investing in R&D to meet growing diagnostic demands. Their efforts are helping bring advanced diagnostics to both established and developing healthcare systems.

Conclusion: Toward a More Personalized and Reliable Transplant Ecosystem

The transplant diagnostics market is entering a period of rapid evolution. As organ transplant volumes rise globally, the importance of accurate, fast, and individualized diagnostic tools becomes paramount. With growing public awareness, supportive policies, and the integration of advanced technologies, the future of transplant diagnostics looks promising. The industry’s focus on precision medicine and global accessibility ensures that more patients can benefit from safe and successful transplants in the years ahead.

Transplant Diagnostics Market Outlook 2025–2035: Revolutionizing Transplant Success Through Precision Medicine

The field of transplantation has made remarkable strides in recent decades, and at the core of this progress lies a critical component—transplant diagnostics. These are the tests and technologies that ensure successful donor-recipient matches and monitor post-transplant health. According to the latest data, the global transplant diagnostics market, valued at US$ 7.8 billion in 2024, is set to more than double by 2035, reaching US$ 17.2 billion, driven by a compound annual growth rate (CAGR) of 7.3%.

Shifting Demographics and Technological Progress Fueling Market Growth

A confluence of factors is accelerating the demand for transplant diagnostics. Increasing prevalence of chronic illnesses, longer life expectancies, and an aging global population are pushing the need for organ and tissue transplants. Simultaneously, advancements in molecular diagnostics, biomarker discovery, and genetic testing are making it possible to match donors and recipients with unprecedented accuracy.

Government policies and regulatory support are also instrumental. Public health agencies and NGOs are launching campaigns that promote organ donation and demystify transplant myths, leading to a larger donor pool. The need for reliable diagnostics to ensure compatibility, reduce rejection risks, and monitor transplant health post-surgery has never been more pressing.

Market Dynamics: What’s Driving the Surge in Demand?

- Rising Organ Transplant Volumes

With transplant programs expanding worldwide, especially in developing nations, transplant procedures are becoming more common. In the U.S., for example, 48,149 organ transplants were performed in 2024, representing a 3.3% year-over-year increase. As transplant volumes rise, so does the demand for reliable diagnostics that minimize risk and enhance outcomes. Physicians are relying more on molecular tools to evaluate compatibility, track immune responses, and predict long-term transplant success.

- Growing Public Awareness and Donor Registrations

Awareness campaigns and social media outreach have played a pivotal role in encouraging organ donation. As more individuals enroll as donors, hospitals and transplant centers are experiencing higher patient flow, making diagnostics indispensable. The rise of digital health platforms and storytelling via online channels have humanized the process of donation and transplantation, creating a positive feedback loop of increased registrations and diagnostic demand.

Market Segmentation Highlights

Kits and Reagents Take the Lead

The kits and reagents segment dominates the global transplant diagnostics market, owing to their frequent use in testing processes, particularly HLA typing, cross-matching, and immunologic profiling. These products are essential for hospitals and labs to quickly and accurately assess compatibility. Their rising use in pre-transplant screening has made them the largest contributor to overall market revenue.

Molecular Assays: The Backbone of Precision Diagnostics

Molecular assays hold a majority market share due to their precision, speed, and sensitivity. Technologies such as polymerase chain reaction (PCR) and next-generation sequencing (NGS) allow clinicians to detect even the smallest immunological differences. These assays are also used for infectious disease screening in potential donors and recipients—an essential step in preventing complications.

Regional Insights: North America at the Forefront

North America is the dominant region in the transplant diagnostics space, led by the U.S. This can be attributed to its advanced healthcare infrastructure, strong R&D investments, and a high number of transplant procedures annually. The presence of major players such as Thermo Fisher Scientific, Abbott, and QIAGEN ensures that innovative diagnostic tools are widely available and continuously improved. Stringent regulatory standards in the region further reinforce the use of advanced diagnostics to ensure patient safety and transplant success.

Emerging Technologies and Industry Innovations

The field of transplant diagnostics is being reshaped by new technologies like artificial intelligence (AI) and machine learning, which are improving lab workflows, enhancing data interpretation, and aiding predictive analysis. These tools are enabling a transition from traditional diagnostics to personalized transplant medicine, where treatments and monitoring strategies are tailored to each patient’s genetic and immunological profile.

Recent developments highlight the industry’s focus on innovation. For example, QIAGEN’s update to its EZ2 Connect platform allows automated processing of cfDNA from plasma and urine—supporting non-invasive biopsy techniques. Thermo Fisher’s new risk assessment assay offers clinicians insights into acute rejection risks before the transplant, aiding personalized immunosuppressive therapy planning.

Key Players Shaping the Market

Prominent companies include:

- Abbott

- QIAGEN N.V.

- Thermo Fisher Scientific

- F. Hoffmann-La Roche Ltd.

- Bio-Rad Laboratories

- Illumina, Inc.

- Siemens Healthineers

These companies are actively pursuing strategic collaborations, expanding into emerging markets, and investing in R&D to meet growing diagnostic demands. Their efforts are helping bring advanced diagnostics to both established and developing healthcare systems.

Conclusion: Toward a More Personalized and Reliable Transplant Ecosystem

The transplant diagnostics market is entering a period of rapid evolution. As organ transplant volumes rise globally, the importance of accurate, fast, and individualized diagnostic tools becomes paramount. With growing public awareness, supportive policies, and the integration of advanced technologies, the future of transplant diagnostics looks promising. The industry’s focus on precision medicine and global accessibility ensures that more patients can benefit from safe and successful transplants in the years ahead.