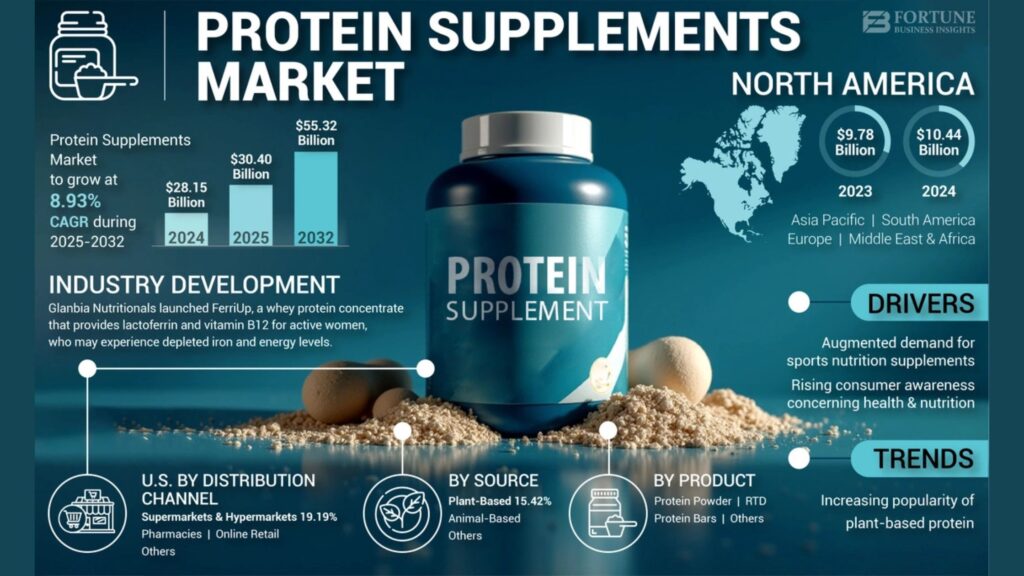

The global protein supplements market was valued at USD 28.15 billion in 2024. It is expected to grow from USD 30.40 billion in 2025 to USD 55.32 billion by 2032, exhibiting a CAGR of 8.93% during the period from 2025 to 2032. The U.S. protein supplements market is projected to see considerable growth, reaching a value of USD 22.58 billion by 2032. In 2024, North America led the protein supplements market with a share of 37.09%.

An increase in purchasing power parity (PPP) is anticipated to accelerate the demand for ready-to-drink (RTD) products in the near future. Additionally, the growing popularity of dried fruit snacks, influenced by changing lifestyles, is expected to support segment expansion over the next seven years. Moreover, rising demand for protein bars, RTDs, and powders among professional athletes, fitness enthusiasts, and casual users is likely to stimulate market growth. The strong presence of brands such as Optimum Nutrition, Inc., Quest Nutrition, Bio-Engineered Supplements and Nutrition, Inc. (BSN), NOW Foods, United States Nutrition, Inc., MusclePharm, MuscleTech, and Met-Rx Substrate Technology, Inc. is also expected to contribute to market expansion.

Information Source: https://www.fortunebusinessinsights.com/protein-supplements-market-106511

Segments:

Growing Demand for Animal-Based Protein Supplements Supported by Health Benefits and Scientific Research

By source, the market is categorized into animal-based, plant-based, and others. Demand for animal-based protein supplements is expected to rise significantly, backed by research highlighting their health benefits. For example, whey protein supports immune function, enhances nutritional status, and raises glutathione (GSH) levels in cancer patients undergoing chemotherapy.

Protein Powder Market Growth Fueled by Strong Online and Distribution Presence

By product, the market is segmented into protein powder, RTD, protein bars, and others. In 2022, protein powder held the largest share at 55.86%, supported by strong online sales performance and an extensive distribution network. Key players like Glanbia, Nature’s Bounty Co., and Iovate Health Sciences International Inc. are projected to further drive growth in this segment.

Private Label Investments by Hypermarkets and Supermarkets Encourage Sales of Protein Products

By distribution channel, the market is segmented into supermarkets and hypermarkets, pharmacies/drug stores, online retail, and others. In 2022, supermarkets and hypermarkets emerged as the top sales channels. Major U.S. retailers such as Walmart are investing in private label offerings to promote protein product consumption.

Geographically, the market is assessed across North America, Europe, Asia Pacific, South America, and the Middle East and Africa.

Report Coverage:

The report includes:

- Key drivers, restraints, opportunities, and market challenges

- In-depth analysis of regional market developments

- Profiles of major industry players

- Strategic initiatives undertaken by key players

- Recent industry developments, including product innovations, partnerships, mergers, and acquisitions

Drivers & Restraints:

Awareness Campaigns and Advanced Technologies Fuel Market Expansion

Numerous campaigns by governments, NGOs, and businesses aim to educate consumers on the benefits of protein supplements. Technologies like micro-encapsulation and nano-encapsulation—known for controlled release and minimal ingredient use—are gaining popularity. However, high manufacturing costs and raw material price volatility could pose challenges to market growth.

Regional Insights:

North America Leads Due to High Protein Snack Consumption

North America holds a leading position in the market, driven by growing health consciousness across the U.S., Canada, and Mexico. Increased consumption of protein bars and cookies among millennials is projected to boost the region’s market share.

In Europe, the market is expected to expand due to rising interest in functional food products.

Competitive Landscape:

Key Players Expand Production Capacity to Meet Global Demand

Notable companies include Muscle Pharm, RSP Nutrition, Glanbia Plc, and BRF. With only a few major players operating globally and regionally, the market remains consolidated. These companies are prioritizing the expansion of production facilities to meet increasing global demand.

Get Sample PDF Brochure: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/protein-supplements-market-106511

Key Industry Development:

In August 2021, Glanbia Nutritionals introduced KetoSure MCT, a new keto-friendly powder ingredient that combines MCT oil with whey protein. This innovation is designed to help manufacturers create sports nutrition and weight management products tailored to the keto market.

List of Key Players Featured in the Report:

- Glanbia Plc (Ireland)

- MusclePharm (U.S.)

- Abbott (U.S.)

- CytoSport, Inc. (U.S.)

- Quest Nutrition (U.S.)

- The Bountiful Company (U.S.)

- The Himalaya Drug Company (India)

- NOW Foods (U.S.)

- RSP Nutrition (U.S.)

- BPI Sports LLC. (U.S.)